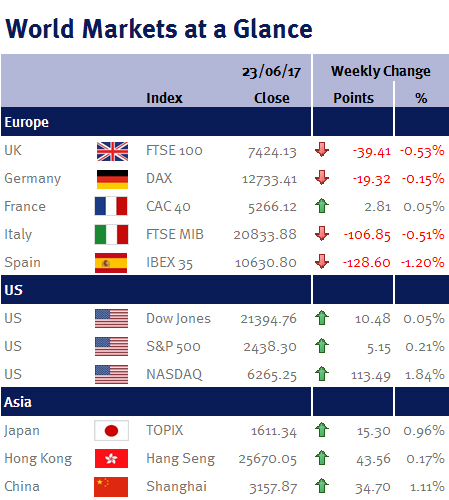

Week ending 23rd June 2017.

26th June 2017

It’s hard to believe it was a year ago to the day (23 June 2016) that the UK public voted to leave the EU! And while the UK’s economic resilience has been a surprise, it should be remembered that before the referendum the then Prime Minister, David Cameron, said that he would immediately invoke Article 50 and start exit negotiations if that was the decision of the public. Instead he resigned, Article 50 wasn’t triggered until 29 March 2017 and negotiations on leaving only started this week (Monday 19 June 2017).

And after being criticised last year for his Brexit views, Mark Carney, the Governor of the Bank of England this week reiterated the impact and risks of Brexit on the UK economy (in terms of consumer spending, business investment, the current-account deficit and the financial-services industry).

Adding to this week’s central bank roller-coaster ride were speeches made from a number of the US Fed officials. William Dudley, the President of the Federal Reserve Bank of New York, acknowledged that inflation data had been unexpectedly weak in recent months, but said that he expects that it will rebound due to a tight employment market and as a consequence the Fed will continue to raise interest rates. However, Charles Evans the Chicago Fed President, struck a more dovish tone, saying that while the current environment supported the increases so far, it was important to see higher inflation data as “last week’s CPI data does not bode well for PCE inflation in May” and that “it remains to be seen whether there will be two rate hikes this year or three”. The Dallas Fed President, Robert Kaplan, struck a similar tone, saying it would be wise to be patient and wait for more evidence that the recent weakness in inflation was temporary, while the Boston Fed President, Eric Rosengren, said that low interest rates pose financial stability risks. Then the St. Louis Fed President, James Bullard said that the Fed’s projected rate path is unnecessarily aggressive as recent data suggests that the inflation slowdown is broad-based.

In my opinion, given that the Fed plans to reduce their balance sheet (reversing QE), I continue to believe that US interest rates will rise at a much slower and shallower rate than currently forecast by the Fed (according to the ‘Fed-dot plot’ there will be three rate hikes per year in 2017, 2018, and 2019, which would take US interest rates up from a range of 1.00%-1.25% to 2.75%-3.00% by the end of 2019). And as I have said before inflation will not sustainably rise while core inputs (such as oil) are falling – which brings me neatly onto this week’s other big story: oil, which suffered its fifth weekly decline.

Brent oil fell to $45.18, while WTI crude traded below $43 (for the first time since April 2016) on realisation that rising shale output was blunting the impact of OPEC’s production cuts (I have long argued that shale was a game changer and has replaced OPEC as the price setter). Although OPEC is said to be discussing making further curbs to supply, I would speculate that reaching a deal will be very difficult, given Libya (which has increased supply by over 300,000 barrels a day since the OPEC cuts were agreed last November) and Nigeria are exempt, while Iran is unlikely to accept a reduction as it looks to recover market share lost while under sanctions.

We have a quiet week ahead, as the big data releases of the month are mostly out of the way, although we do have US PCE (the Fed’s preferred inflation gauge) and eurzone CPI. However, central bankers have another busy week with a number of key speeches. Mario Draghi presides over the ECB’s annual forum in Portugal. Janet Yellen is speaking in London (at the British Academy) on ‘global economic issues’ on Tuesday (27 June 2017), and on the same day, Mark Carney presents his biannual Financial Stability Report.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.