Week ending 13th October 2017.

16th October 2017

Data this week showed how much more the UK imports than it exports as the trade deficit continued to widen despite the large depreciation in the pound since the EU Referendum vote last June. And although there is a risk that the UK is miscalculating how far Europe is willing to compromise after Theresa May’s government ‘hardened’ its negotiating stance this week by saying that they were preparing for a “no-deal” Brexit outcome (as a hard Brexit would be negative for the UK), this trade data clearly shows that the eurozone will also suffer badly (and should hopefully give the EU an incentive to compromise).

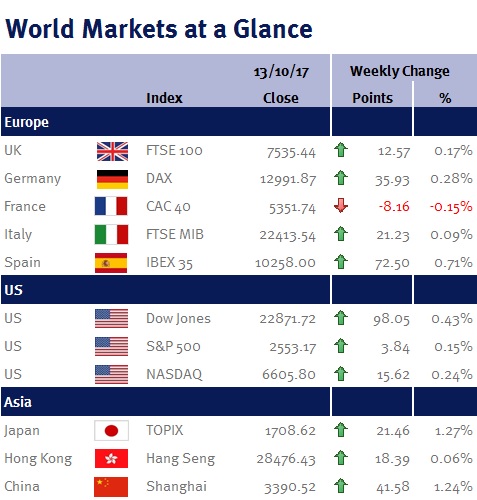

Elsewhere in Europe, Spanish equities traded higher after Catalonia’s president offered talks with Madrid while claiming a mandate to trigger secession. Overall, as with last week (please see here), the market reaction to the political turbulence has been muted – which is not a surprise, given the European Commission is backing the Spanish Prime Minister, Mariano Rajoy’s position on Catalonia, and reinforces the view that Catalonia is isolated within the EU.

And this week finished (Friday 13 October 2017) with the release of US CPI inflation data for September. The report was clearly impacted by a spike in energy prices after the recent hurricanes as headline inflation picked-up to 2.2% (up from 1.9% in August), as core CPI (which excludes volatile items such as food and energy and is seen as a signal of where headline inflation will head) was unchanged at 1.7%.

Consequently, another interest rate increase this year is far from certain – especially given a number of Fed policymakers were speaking this week: Robert Kaplan, the Dallas Fed President, said he wants to see more signs of upward inflation before raising interest rates and repeated his concern that globalisation and technology is keeping US inflation muted despite near-full employment, while Chicago Fed President Charles Evans said a December interest rate increase was not a done deal and that the key for the Fed is to deliver 2% inflation on average and not have it as a ceiling.

Next week there are lots of exciting data releases to look out for from China and the UK (which will provide clues on the outlook for UK interest rates). UK data includes: CPI; employment/earnings data; and retail sales. Chinese data includes: CPI; GDP; retail sales; and industrial production. Additionally, we have eurozone CPI; the US Empire Manufacturing survey; and the Fed’s Beige Book. And on Monday (16 October 2017), we have Madrid’s deadline for clarity on Catalonia’s independence claim.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.