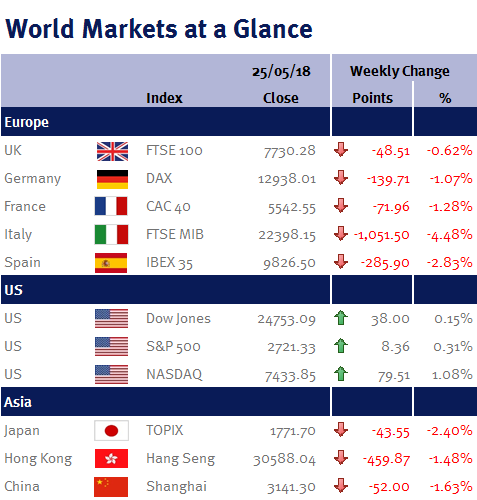

Week ending 25th May 2018.

29th May 2018

lower); and North Korea (cancelled summit).

The minutes of the last Fed monetary policy meeting (when they left the benchmark rate unchanged at a range of 1.5% to 1.75%) indicated that most policymakers see the next interest rate increase coming “soon” (so expect an increase at their next meeting on 12-13 June 2018).

In the UK, while the CPI inflation reading fell to 2.4% from 2.5% as the effect from the pound’s sharp fall following the Brexit vote falls out of the data, it doesn’t change my view: I still don’t believe that the BoE should increase interest rates this year – especially after both Rightmove and the ONS this week reported weaker London house prices (which will ultimately have a negative impact on consumer confidence and spending), while it was announced today (Friday 25 May 2018) that the second reading of Q1 GDP was unchanged at 0.1%. As I wrote on Friday 11 May 2018 (please see here), Mark Carney, the Governor of the BoE, bizarrely stated that he expected this reading would be revised upwards to 0.3% – and this unfortunately is another example of how the BoE has struggled to read the direction of growth and inflation since the Brexit vote. As an aside, while inflation is likely to continue to fall, the pace of the decline may slow following the recent spike in oil prices.

The highlights of this week coming include: US PCE (the Fed’s preferred inflation measure); US employment data (non-farm payrolls; unemployment rate; the participation rate; and average earnings); China’s trade balance and PMI; and eurozone CPI.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.