This fragility was highlighted yesterday (Thursday 20 August 2020) as US initial jobless claims increased back above 1m. Although ‘bad news can be good news’, in that it can result in more support and stimulus from the governments and/or central banks, unfortunately, this jobless data reading failed to break the political deadlock in Washington as the Republicans and Democrats remain in stalemate at the expense of hard-hit American workers and the US economy.

However, this doesn’t mean that the US economic recovery is starting to falter, as today’s (Friday 21 August 2020) PMI and home sales data came in much stronger than expected. Existing home sales rose by nearly 25% on an annualised basis to 5.86m (the highest rate since December 2006); while manufacturing PMI rose to 53.6 from 50.9 and services PMI climbed to 54.8 from 50.0 – and as 50 is the line separating expansion and contraction, these readings not only show that the US economy is moving in the right direction but the recovery is strengthening.

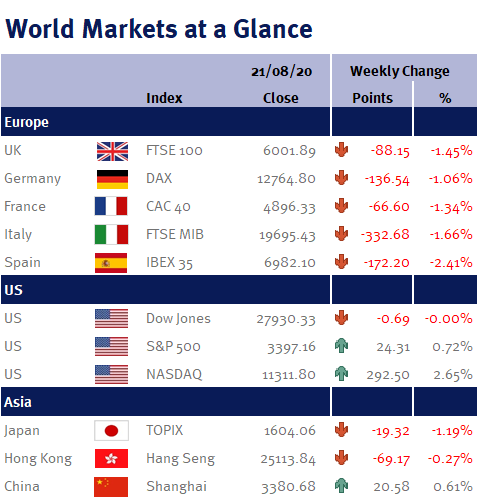

It was a similar story in the UK, as the FTSE-100 completely ignored today’s absolutely stunning PMI and retail sales data, which indicated that consumers returned to high street shops, pubs and restaurants as soon as they reopened, and instead focused on comments by Michel Barnier, the EU’s chief negotiator, who claimed a Brexit deal “seems unlikely” before the transition period ends on 31 December 2020.

We have a relatively quiet economic calendar ahead this week. Of most interest will be the weekly US jobless claims data on Thursday (27 August 2020). Other US data includes: The Chicago Fed National Activity Index; University of Michigan consumer sentiment index; new and pending home sales; durable goods orders; and PCE. Elsewhere we have Japanese CPI inflation and in the UK, the Nationwide Building Society house price index.

Investment Management Team