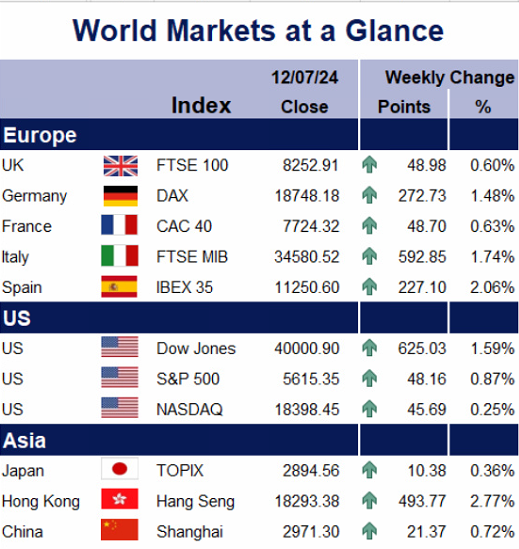

As you can see from the accompanying table markets were in the green this week.

There was positive news in the form of the UK’s latest GDP figures. The economy grew by 0.4% month-on-month in May 2024, an improvement from April’s stagnation and double the anticipated 0.2% rise. The services sector, particularly retail trade, continued to be the primary driver of this growth, growing by 0.3% in May, while the construction sector jumped by 1.9%. The UK economy is well and truly putting last year’s minor recession behind it, something BoE policymakers may need to consider when thinking about when they will initiate their first rate cut.

This week, the Irish cabinet approved the Summer Economic Statement, signalling a significant increase in public spending. The government plans to boost funding for public services by nearly 7% in the upcoming pre-election budget. This move breaks the self-imposed 2021 rule that capped annual public spending growth at 5%. Officials justified the deviation by pointing to an unexpected surge in the Republic of Ireland’s population.

Over in the US, lower than expected inflation data fuelled optimism about potential interest rate cuts. CPI dropped to 3% on year in June (thanks to cheaper gasoline and moderating rents), surpassing expectations and marking a significant decrease from May’s 3.3%. Core CPI, which excludes volatile food and energy prices, rose 3.3% annually, slightly below the forecasted 3.4%.