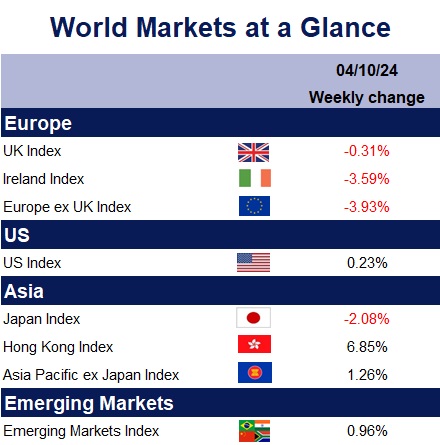

In contrast, US markets managed to close the week higher, despite concerns over the Middle East. Strong economic data helped lift sentiment, with a stronger than expected jobs report showing non-farm payrolls increasing by 254,000 in September and the unemployment rate falling to 4.1%. The resilient labour market reassured investors, following earlier concerns about potential weakness. While the Federal Reserve cut interest rates by 50 basis points last month, policymakers are expected to take a cautious, data-dependent approach moving forward.

In Ireland, the unemployment rate eased slightly to 4.3% in September, down from 4.4% in August, marking its lowest level in five months. The decline suggests a stable labour market despite high interest rates from the European Central Bank. The number of unemployed individuals fell by 1,000 to 124,300, the lowest since April.

In the UK, Bank of England Governor Andrew Bailey hinted that future interest rate cuts could be more aggressive if inflation continues to ease. Bailey’s comments, coupled with concerns over oil price inflation, led to a drop in the pound. He also noted that the Bank was closely monitoring developments in the Middle East, given the potential for higher oil prices to drive inflation.

Meanwhile, in China, markets were mixed as mainland exchanges were closed for the holidays, but Hong Kong markets reopened on Wednesday. Optimism surrounding Beijing’s support measures lifted sentiment, despite weak economic data. Factory activity contracted for the fifth consecutive month, with the official manufacturing PMI at 49.8 in September, while the Caixin survey showed a reading of 49.3. The real estate sector also struggled, with new home sales by top developers falling 37.7% year-on-year in September. While short-term optimism persists, long-term sentiment may shift as focus returns to fundamentals.

Looking ahead, key data releases next week include retail sales in the Eurozone and UK, U.S. trade balance and inflation figures, as well as UK GDP and U.S. producer price index (PPI) and consumer confidence reports. China’s inflation and trade balance data are also expected later in the week.

Kate Mimnagh, Portfolio Economist