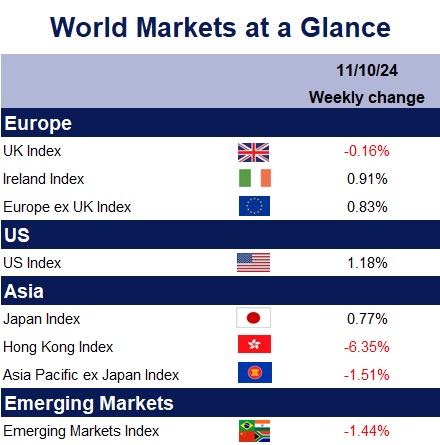

On Thursday, US inflation data took centre stage, delivering mixed results. September’s headline inflation rose by 0.2% and core inflation (excluding food and energy) by 0.3%, both slightly above expectations. Shelter costs increased by 0.2%, while food prices climbed 0.4%, driving the bulk of the monthly increase. With inflation still a focal point for the markets, investors adjusted their expectations for future rate cuts from the Federal Reserve.

NVIDIA’s strong stock performance this week boosted markets, offsetting a decline in Alphabet Inc. (Google’s parent company) after reports that the US Department of Justice (DOJ) may seek to break it up for allegedly causing “pernicious harms” to consumers. This follows an August ruling that found Google guilty of suppressing competition in online search. Google has labelled these potential actions “radical” and maintains its dominance through products like Chrome and Android, which dominate nearly 90% of online searches. If the DOJ proceeds, breaking Google’s hold could foster competition and set a precedent for regulating other tech giants like Meta, Amazon, and Apple.

Friday saw attention shift to major US banks, as JPMorgan and Wells Fargo reported smaller-than-expected third-quarter profit declines. JPMorgan also posted a modest revenue increase, driving a rise in both banks’ shares.

Across the Atlantic, the UK’s monthly GDP estimate for August showed 0.2% growth, in line with expectations, after flat growth in July. However, UK stocks remained muted following the Office for National Statistics’ comment that while all major sectors saw growth in August, the broader trend shows slowing momentum compared to the first half of the year.

Chinese stocks declined during a holiday-shortened week as enthusiasm for Beijing’s stimulus measures waned. On Thursday, there was a positive reaction to the central bank’s announcement of a CNY 500 billion facility aimed at stimulating capital markets. However, over the weekend, all eyes were on China’s Finance Minister, who announced plans to expand support for the struggling real estate sector but did not provide specific figures for monetary stimulus. This left investors speculating about the size of the anticipated financial support.

Adding to investor concerns, China’s inflation data released on Sunday showed consumer prices rising by just 0.4% in September, the slowest growth in three months. Meanwhile, producer prices fell by 2.8%, marking the steepest decline in six months. Both figures fell short of expectations, heightening fears of deflation.

Next week, we can expect key economic reports, including China’s balance of trade, UK unemployment and earnings figures, and Eurozone industrial production. Additionally, the UK inflation rates and the European Central Bank’s interest rate decision will be on the agenda. On Friday, Japan’s inflation data, along with China’s industrial production, GDP, and retail sales figures, will be released.

Kate Mimnagh, Portfolio Economist