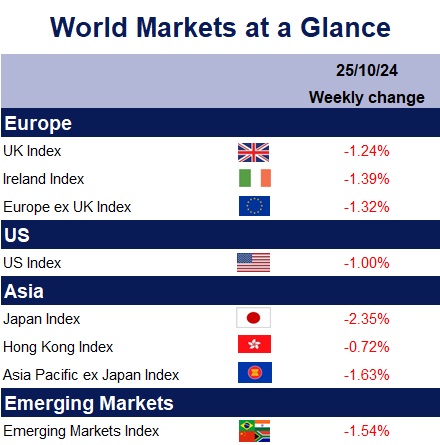

European markets closed lower due to shifting expectations of slower rate cuts from the Fed and their implications for European Central Bank policymakers. Eurozone PMI data revealed that business activity remained in contraction territory but edged up to 49.7 in October from a seven-month low of 49.6 in September. While service-sector growth unexpectedly slowed, the decline in manufacturing was not as severe as anticipated.

So far this month, UK economic indicators have reflected signs of slowing growth and weaker consumer confidence, with surveys noting that “gloomy government rhetoric and uncertainty ahead of the budget” dampened business confidence and spending. The UK composite PMI remained in expansionary territory but fell to 51.7 from 52.6 in September, driven by slower growth in new orders. GFK’s survey also highlighted a decrease in UK consumer confidence, despite inflation returning to the 2% target, likely due to concerns over the Autumn Budget and potential tax increases.

In contrast, stocks fared better as the People’s Bank of China injected liquidity into the banking system, keeping key lending rates unchanged while signalling ongoing support for economic stability. Recent rate cuts by Chinese banks aim to encourage borrowing as part of broader stimulus efforts. Youth unemployment eased slightly in September, offering a positive signal, though it remains high amid continued economic pressures.

Japan’s stock markets declined this week amid pre-election uncertainty. Tokyo’s inflation rose by 1.8% year-over-year in October, slightly easing from September’s 2.0% due to renewed energy subsidies. Bank of Japan Governor Ueda emphasised a cautious approach to policy adjustments to avoid prolonged low-rate expectations and speculative risks. Following Sunday’s election, the country faces political uncertainty, as no party secured a majority. Prime Minister Ishiba’s coalition won 215 seats, falling short of the 233 needed, while the opposition CDPJ gained 148. Parties now have 30 days to negotiate a coalition government.

Next week, Chancellor of the Exchequer Rachel Reeves will present her Autumn Budget on Wednesday, October 30th. Be sure to check for our updates on the day.

In terms of data releases this week, we can expect the following: Eurozone Q3 GDP, inflation, and unemployment rates; Japan’s industrial production and retail sales; and the US core PCE (the Federal Reserve’s preferred measure of inflation), along with non-farm payrolls, the unemployment rate, and the participation rate. Earnings season continues with reports from the “Magnificent Seven”, including Apple, Microsoft, Meta, and Amazon”.

Kate Mimnagh, Portfolio Economist