The Chancellor of the Exchequer, Rachel Reeves, has today delivered the first Labour Budget in 14 years.

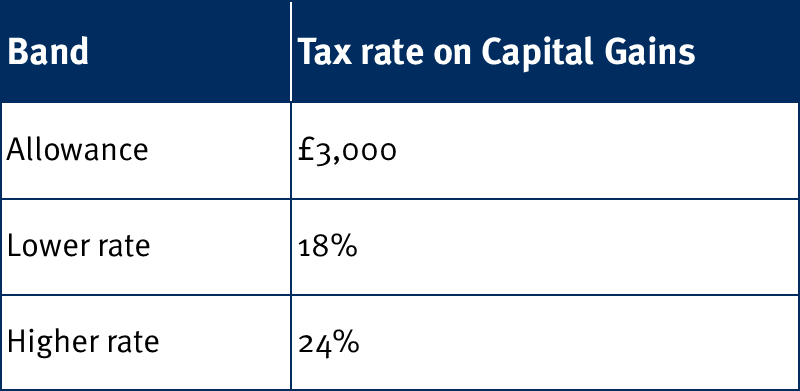

Capital Gains

As always, there was much speculation about potential announcements circulating in the press in the lead up to the Budget. It was therefore no surprise when it was announced that Capital Gains Tax (CGT) rates will increase – however, instead of aligning CGT with income tax (as was widely rumoured), the increase will align with residential property, which is charged at 18% for basic rate taxpayers and 24% for higher rate taxpayers. This increase will be taking place from today, 30 October 2024.

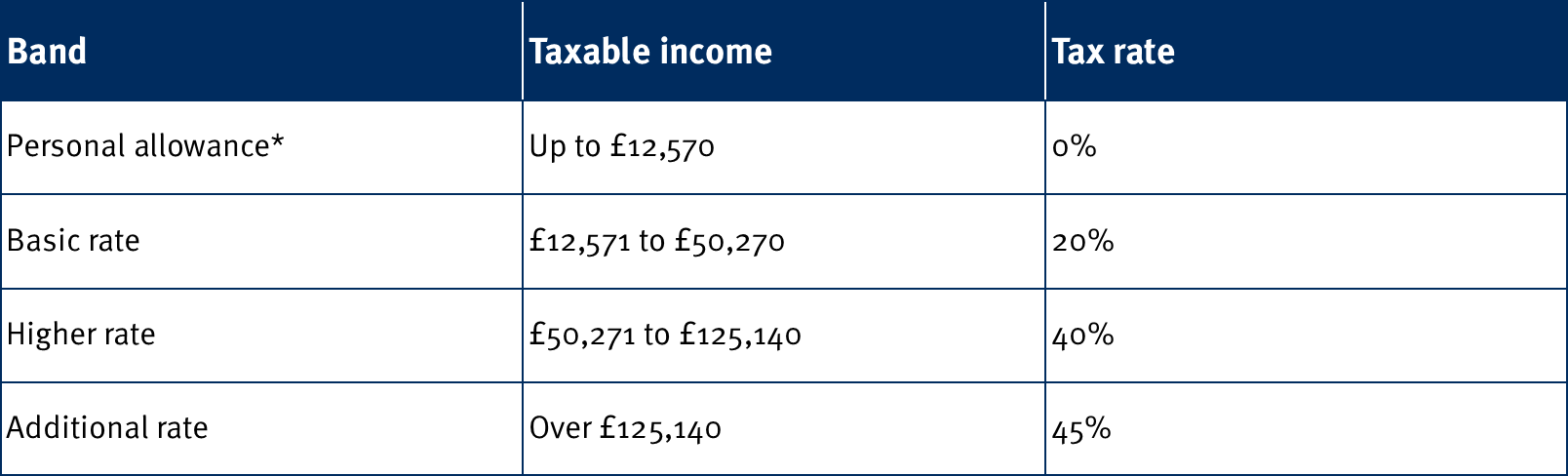

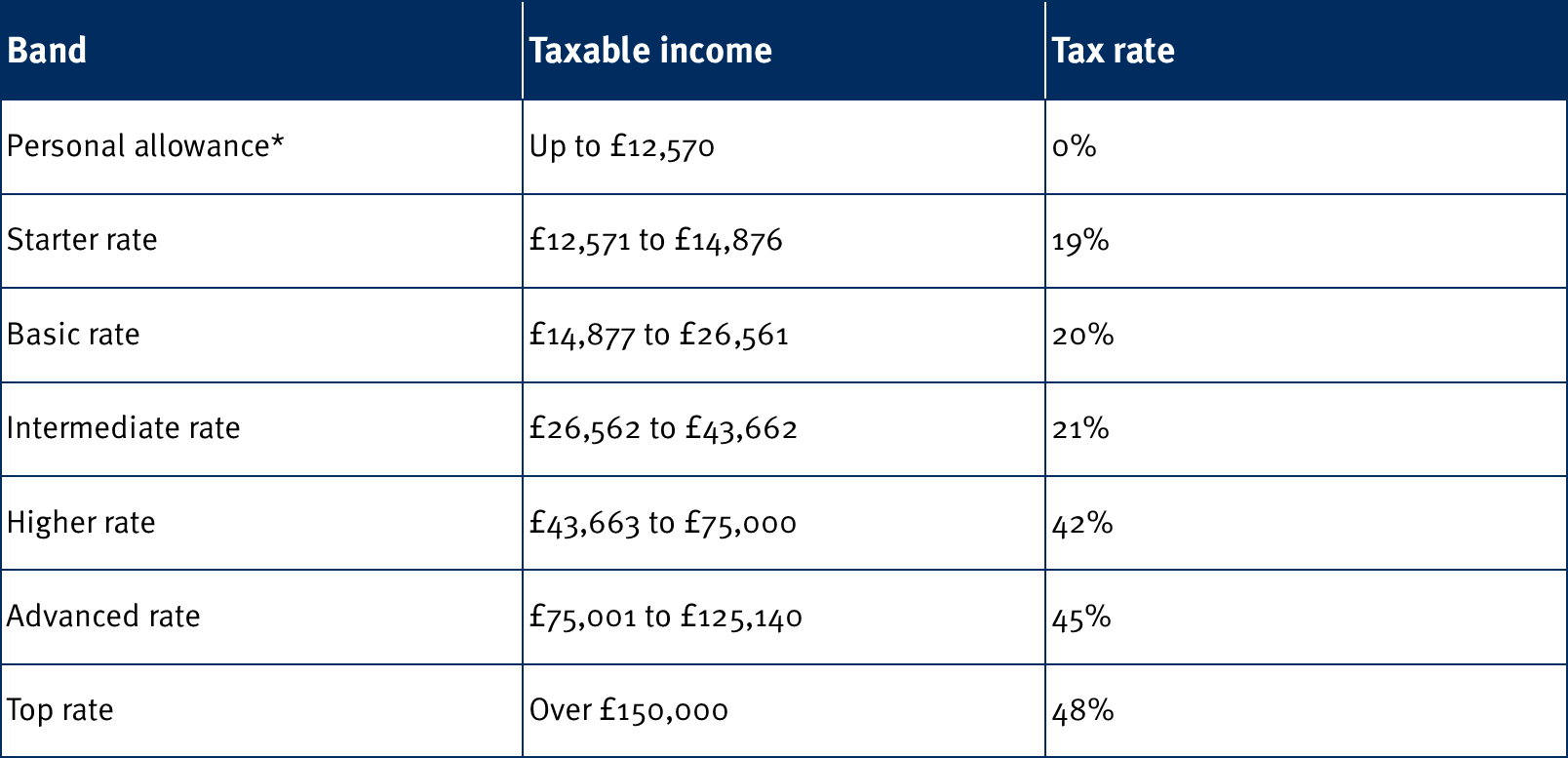

Income Tax

Income Tax band thresholds will continue to be frozen until April 2028, which was put in place by the previous government, and will then start to increase in line with inflation from the 2028/29 tax year. At this point, it will prevent more people being dragged into higher rate tax bands as wages or pension income increases.

Pensions

The State Pension Triple Lock will remain for the duration of this parliament. The basic and new State Pension will increase by 4.1% in 2025/26, in line with earnings growth, meaning over 12 million pensioners will receive up to an extra £470 per year.

Inheritance Tax

Current Inheritance Tax (IHT) thresholds will remain at their present levels until 2030. From 6 April 2027, Pensions will form part of an individual’s estate for Inheritance Tax purposes. This is under consultation and further details will be released in due course.

ISAs

ISAs were also rumoured to be subject to change, such as a lifetime cap being introduced or a reduction in the annual allowance. However, it has been confirmed that Individual Savings Accounts (ISAs) will remain unchanged until at least 2030. The current rates are:

- ISA – £20,000

- Junior ISA – £9,000

- Lifetime ISA – £4,000 (excluding government bonus)

- Child Trust Fund – £9,000.

With recent reductions in the annual capital gains tax exemption, as well as the newly announced increases to capital gains tax rates, making the most of your annual ISA allowance is now more important than ever.

In March 2024, Jeremy Hunt introduced the concept of a new ‘UK ISA’ but this will no longer be going ahead.