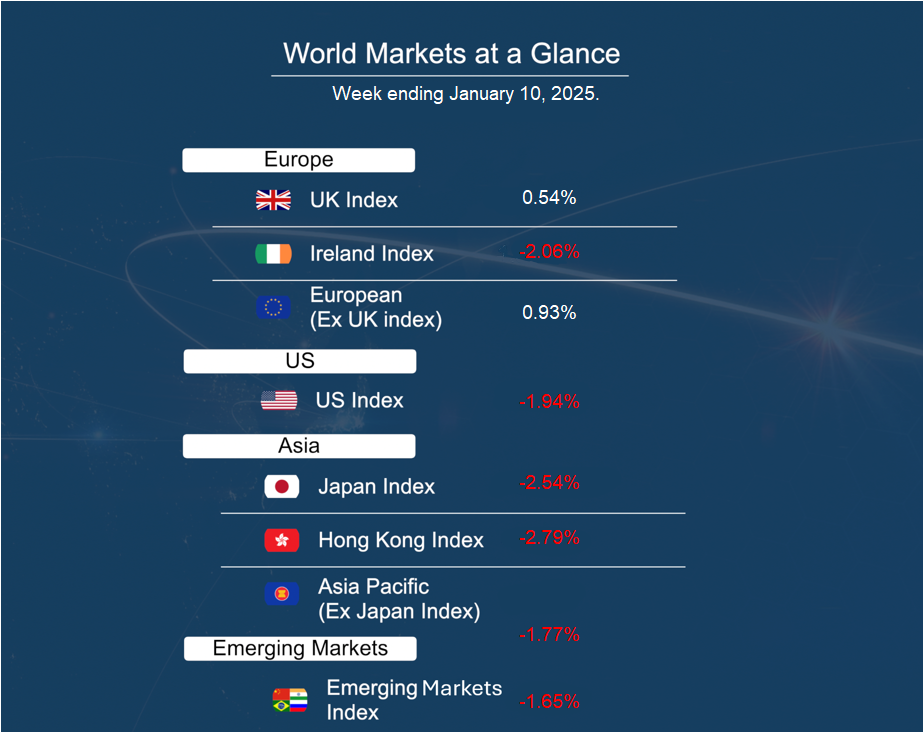

As you can see from the accompanying table, markets were mixed this week.

It was another short week for US markets, which were closed on Thursday, 9th January, in observance of a national day of mourning for former President Jimmy Carter. Federal Reserve minutes from their last meeting in December, where they cut interest rates by 25 basis points, were released on Wednesday. Officials anticipate a considerably slower pace of rate cuts in 2025, with the median respondent expecting 75 basis points for the full year. Without mentioning Trump, policymakers expressed concern about inflation and the potential implications of future immigration and trade policies, indicating that they would move more slowly in 2025 as the extent of Trump’s administration plans come to light. However, Fed members’ expectations indicate that economic growth may moderate, the labour market will remain solid, and inflation will likely stay on track to reach the 2% target.

On Friday, data showed the US added 256,000 jobs in December, far exceeding expectations of 155,000, while the unemployment rate held steady at 4.1%, and wages rose 3.9% year-on-year. The strong labour data highlights a resilient job market but may support a slower pace of Fed rate cuts going forward. Stocks edged lower after the report, contributing to modest weekly declines.