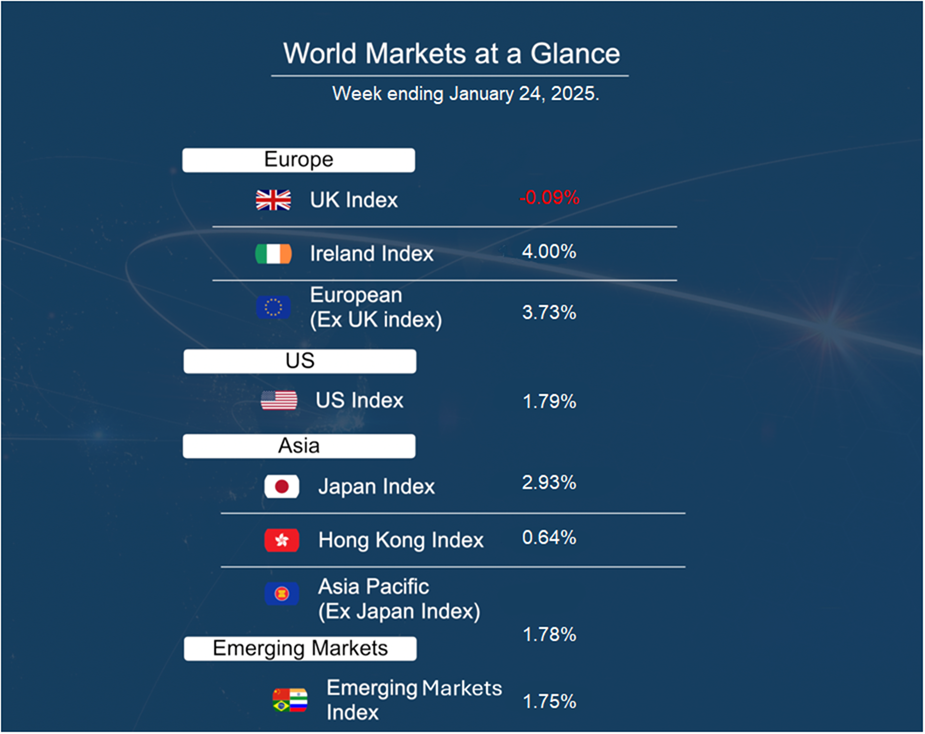

As shown in the accompanying table, it was broadly a positive week for financial markets.

President Donald Trump’s return to the White House was the main focus for investors, as he signed a series of executive orders on his first day back. So far, he has directed federal agencies to take steps to reduce inflation, develop new energy sources, and deport unauthorised immigrants. While he did not impose tariffs on “day one” as he had previously pledged, Trump stated that his administration is considering 25% tariffs on Mexico and Canada. He also announced plans to establish an “External Revenue Service” to collect what he described as “massive amounts of money pouring into our treasury from foreign sources.”

Big tech stocks rallied following the Trump administration’s announcement of a major AI infrastructure initiative, ‘Stargate.’