The move is a positive step in the right direction, lowering borrowing costs for consumers in the form of mortgages, car loans, and credit cards. Lower rates also incentivise businesses to invest in expansion and hiring. Policymakers face the challenge of balancing the risk of a cooling labour market with cutting interest rates appropriately to ensure inflation remains steady at or around the 2% target.

The question now is the terminal value—how far, and how quickly will policymakers go about their easing cycle? Jerome Powell noted that they are by no means on a pre-set course and will continue to make decisions meeting by meeting.

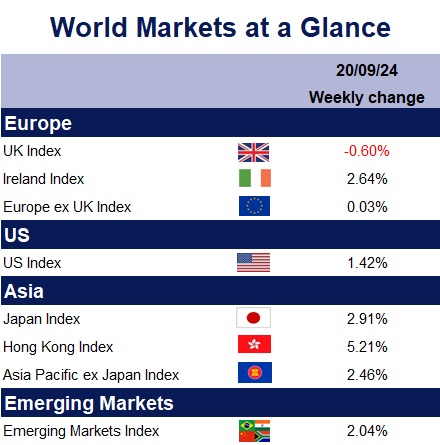

While the stock market initially responded positively, stocks reversed gains by the close as investors processed the implications of the cut. However, after more time to digest the move, markets swiftly rallied on Thursday, taking the 0.5% cut as a sign that the Fed now has confidence that inflation is under control and that the economy may be on track to achieve the so-called “soft landing”—whereby policymakers ease inflationary pressures while keeping unemployment low and ensuring steady economic growth. In essence, it’s about cooling the economy just enough to avoid a more severe economic slowdown or recession. The Fed’s “dot plot” projections also caught attention, forecasting a lower trajectory for interest rates over the coming year. Policymakers anticipate the federal funds rate to hit 3.4% by the end of next year, a downward revision from earlier forecasts.

Next up was the Monetary Policy Committee’s (MPC) decision on Thursday. As expected, the Bank of England held interest rates steady at 5% after a 25-basis-point cut last month. Governor Andrew Bailey justified the unchanged rate by saying, “provided there aren’t any inflation surprises, we should be able to reduce rates gradually over time.” He added, “but it’s vital that inflation stays low, so we need to be careful not to cut too fast or by too much.”

While borrowers may need to withstand higher rates for just a little longer, the good news is that inflation appears to be stabilising. August’s inflation remained unchanged at 2.2%, which was higher than the Bank of England’s 2% target, but below the 2.4% the Bank had predicted at this stage. It may not be too long before policymakers initiate another cut, which would provide further relief to borrowers and be welcomed by financial markets.

Economic data for the UK was somewhat mixed towards the end of the week and the FTSE 100 closed the week lower. While consumer confidence fell in September, shoppers appeared to splurge in August. Retail sales rose 1%, hitting their highest level in more than two years, beating expectations of just 0.4%. Conversely, consumer confidence fell sharply in the prior month, with survey results citing households nervously awaiting next month’s autumn Budget. Look out for our communications in the lead up to the Budget, along with a summary of the announcements and market update on the 30th October. Public finances faced some challenges in August, with public sector borrowing reaching £13.7 billion, surpassing forecasts and raising net debt to 100% of GDP. This represents the highest borrowing figure for August on record, outside of the pandemic years. While tax receipts saw an uptick, rising costs for public services and benefits, driven by inflation, have added pressure to government spending.

Policymakers in both Japan and China also made decisions on Friday, with central banks in both countries leaving interest rates unchanged.

After all this excitement, next week is set to be quieter. Data wise, we can expect PMI data for the UK, US, Japan and across the Eurozone. US durable goods orders and the Federal Reserve’s preferred measure of inflation Core PCE.

Kate Mimnagh, Portfolio Economist