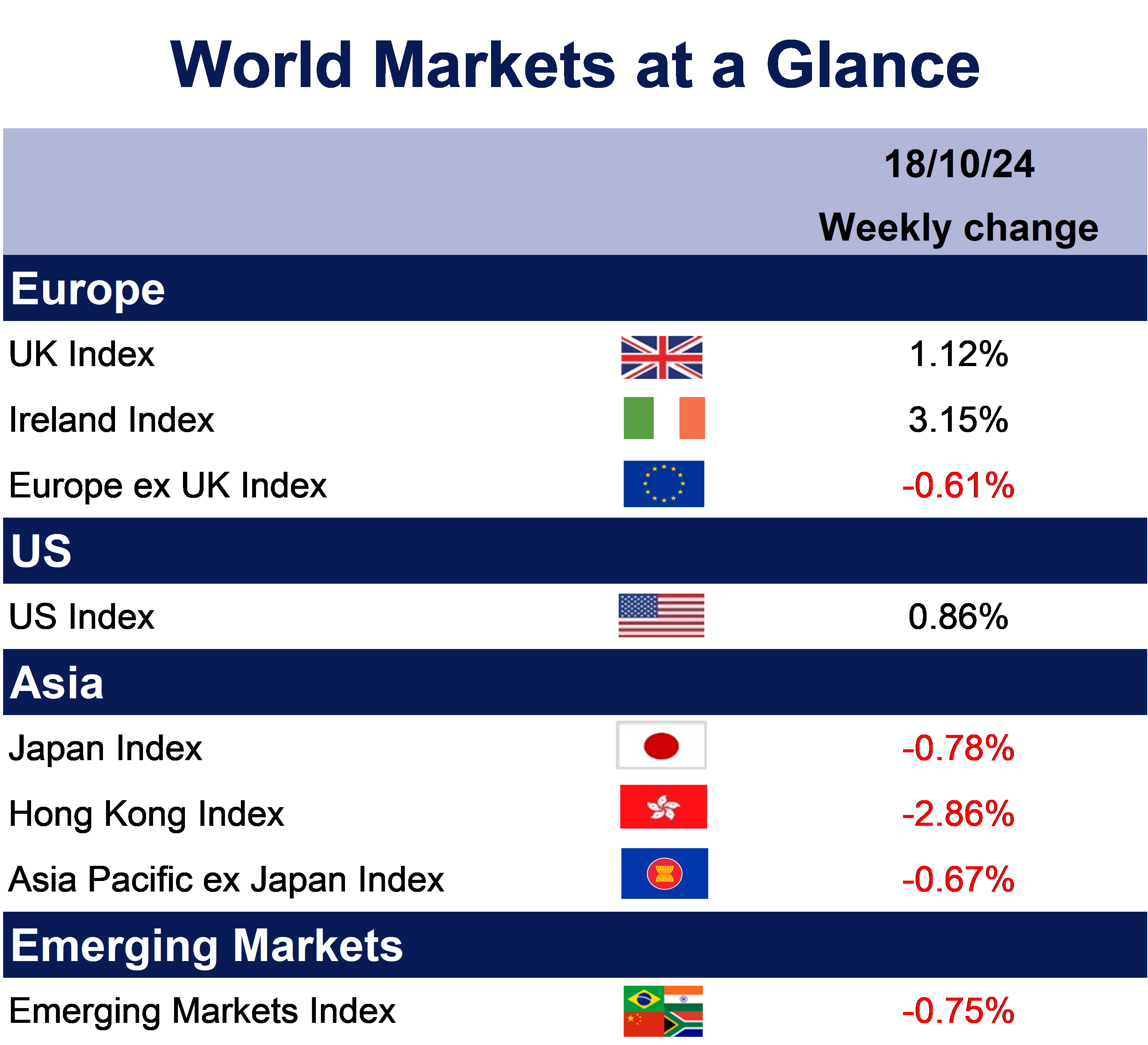

Overall, it’s been a mixed week for markets with plenty of Q3 earnings and economic reports for investors to digest.

In Europe, stocks rallied on Thursday following the European Central Bank’s (ECB) decision to cut interest rates for the third time this year. Policymakers reduced the deposit facility rate by 0.25%, bringing it to 3.25%, in response to inflation dipping below the 2% target in September. ECB President, Christine Lagarde, expressed cautious optimism, stating that current data suggests the economy is on a soft-landing trajectory and not heading into recession.

However, Lagarde highlighted that risks to economic growth remain skewed to the downside, citing lower confidence, which is slowing the recovery of consumption and investment, as well as geopolitical tensions and reduced demand for exports due to a weak global economy. While the ECB had not anticipated the 1.7% inflation reading in September, Lagarde noted that they still expect inflation to rise in the coming months, partly due to the fading impact of earlier sharp declines in energy prices. She expressed increased confidence in reaching the 2% inflation target sustainably but emphasized that there is no predetermined path, and policymakers will remain ‘data-dependent,’ not just ‘datapoint-dependent.’