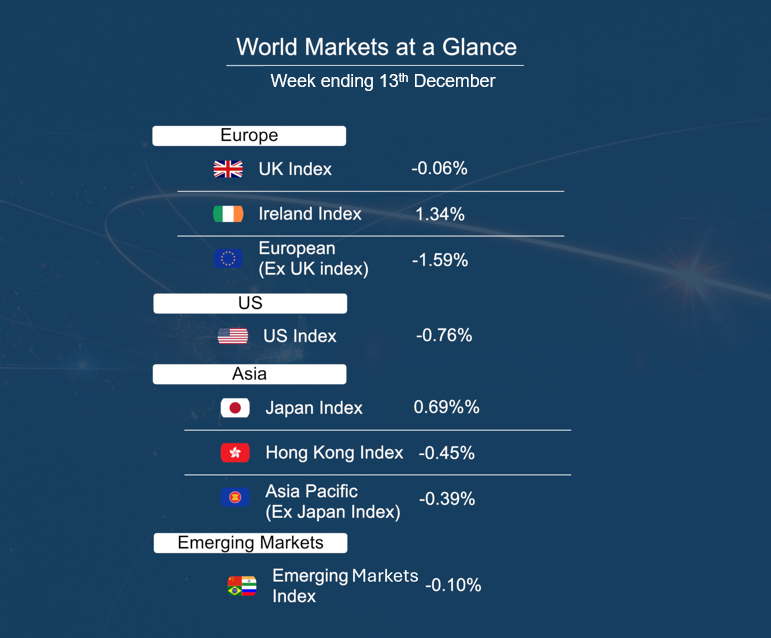

As you can see from the accompanying table, it was a mixed week for markets with key economic data points to digest, ahead of final interest rate decision meetings for major central banks.

US inflation data was a focal point for investors this week with the Federal Reserve’s last policy meeting of the year set to commence on the 17th of December with an announcement on the rate decision made the following day. The Consumer Price Index (CPI) rose 2.7% higher year-on-year in November, while core inflation held steady at 3.3%. On a monthly basis, the index rose 0.3%, faster than the 0.2% rate in the previous month.

On Thursday, the US Labour Department reported a surprise jump in weekly initial jobless claims to a two-month high of 242,000. While some of the increase was attributed to seasonal factors around the Thanksgiving holiday, continuing claims also rose and remained near three-year highs, a sign that it is taking longer for some unemployed individuals to find a job. The jobs data served as another indication of a softening labour market following the prior week’s report of an uptick in the unemployment rate in November. Despite the stalled progress in inflationary pressures, the combination of weak labour data and steady inflation has led markets to price in a 25 basis point rate cut at the upcoming Fed meeting.