It was a shortened trading week in the West, with markets in the US, UK, and Europe closed for Good Friday, and UK and European bourses staying shut through Easter Monday.

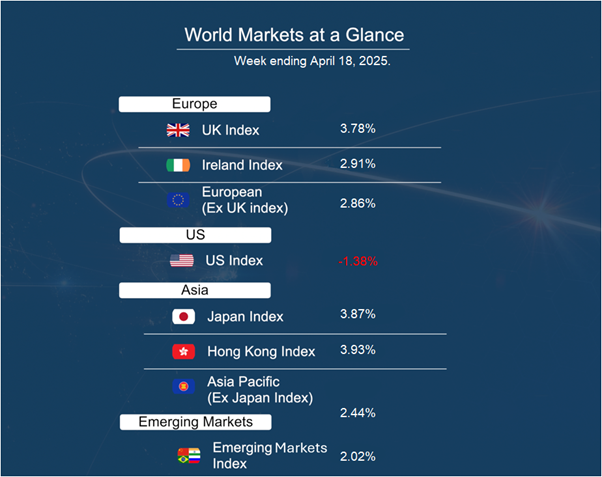

The week saw mixed performances across regions. UK and European equities ended the week higher, while US markets slipped. The Nasdaq and S&P 500 fell, dragged down by tech stocks after chipmakers declined on news of fresh US restrictions on semiconductor exports to China. AI-linked firms like NVIDIA and AMD were hit hardest.

Adding to the unease were comments from Federal Reserve Chair Jerome Powell. Speaking in Chicago, Powell offered a reminder that tariffs come at a cost—namely, higher inflation and slower growth. While he acknowledged the Fed is in no rush to make policy moves, markets interpreted his remarks as a sign that rate cuts may not be imminent after all.

Not all US data disappointed—March retail sales rose 1.4%, beating forecasts. Vehicle-related sales surged 5.3%, as buyers moved ahead of possible tariff hikes.