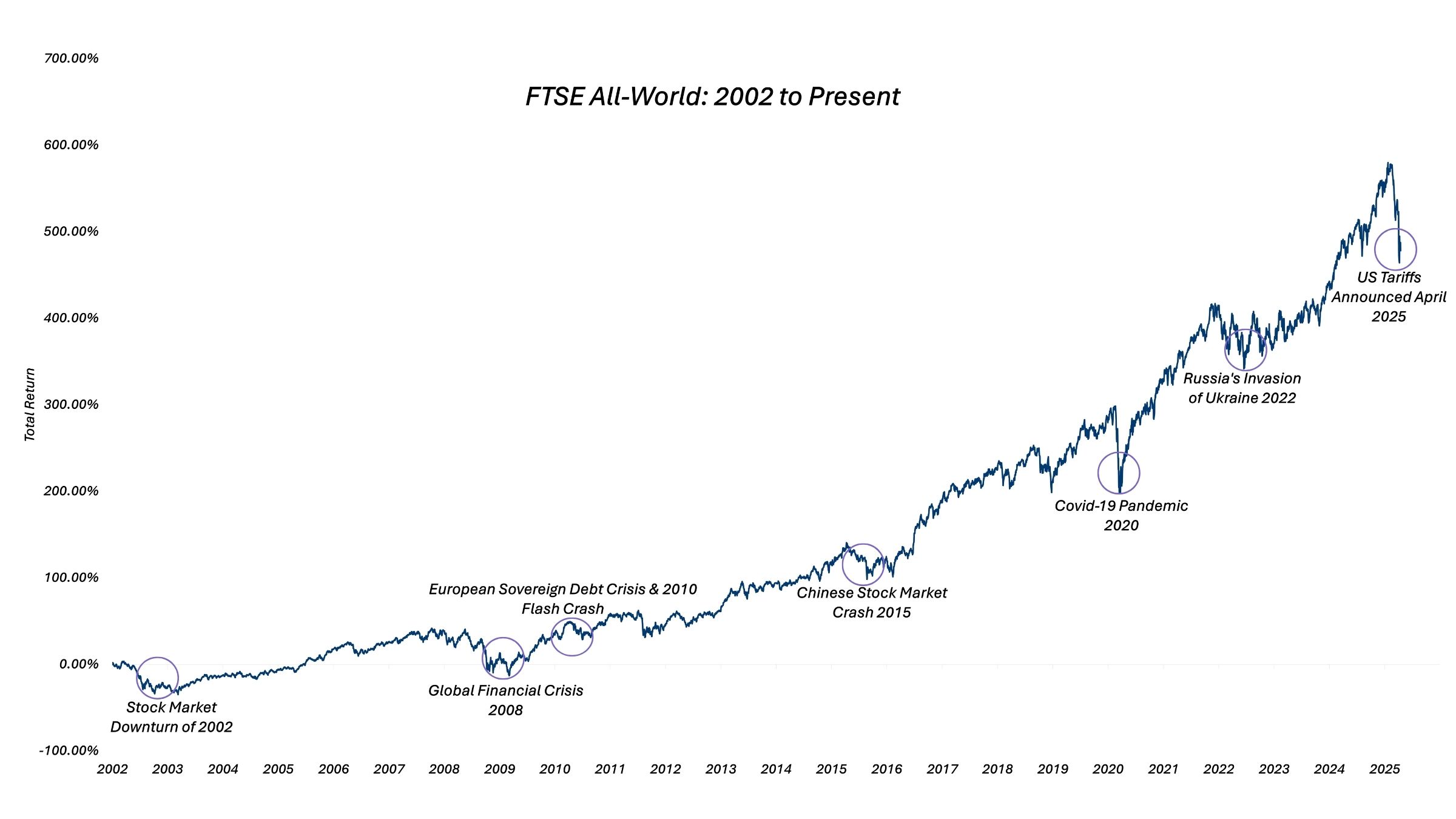

History is filled with moments that felt deeply unsettling at the time:

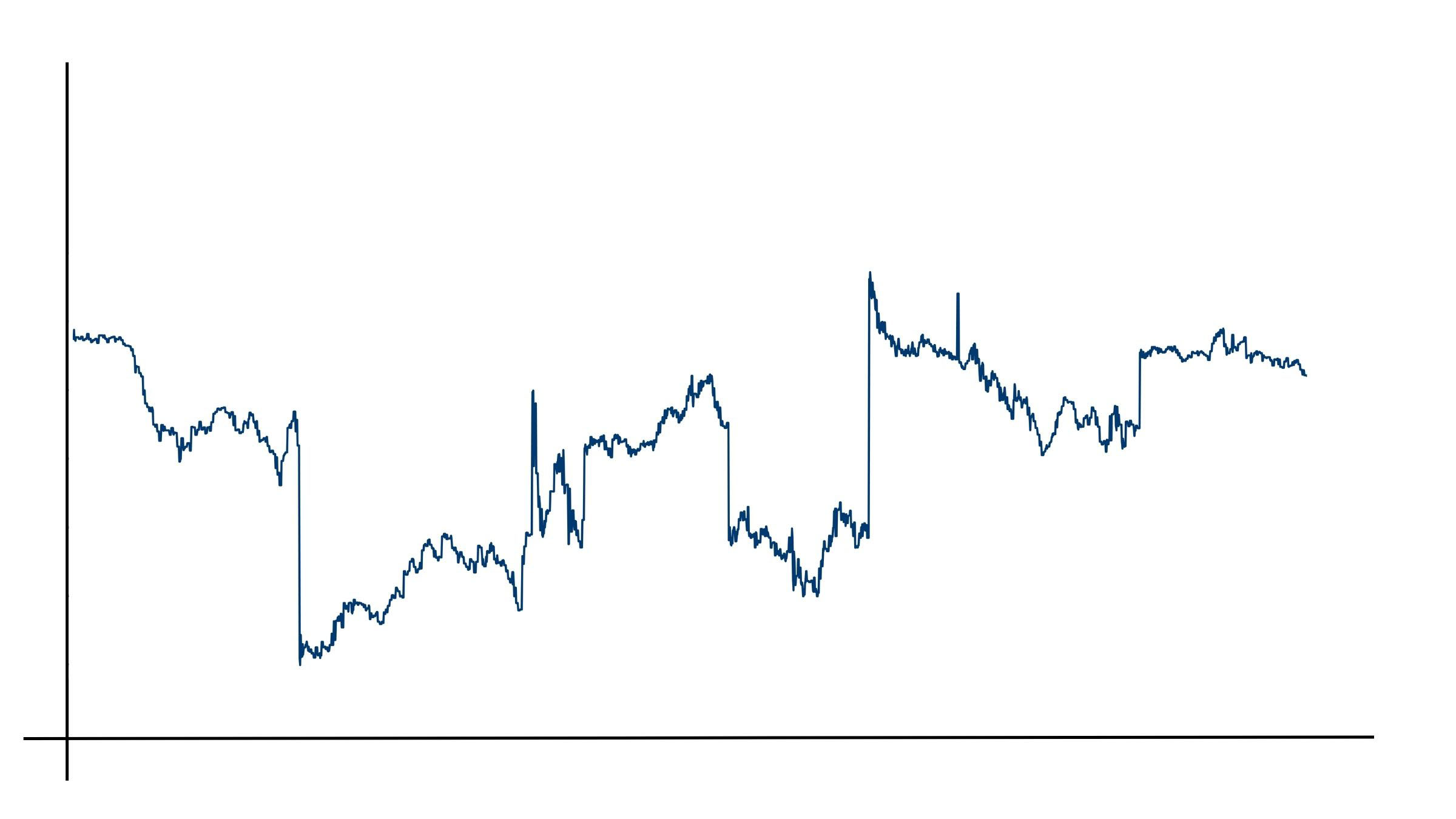

- The Global Financial Crisis (2008), when markets fell sharply in response to a banking system collapse

- The European Debt Crisis (2011), which raised fears over sovereign defaults

- The COVID-19 pandemic (2020), which caused a historic market drop in a matter of weeks

- The Russia-Ukraine conflict (2022) and the global energy and inflation shock that followed

Despite each of these events, markets recovered – and went on to reach new highs. These examples serve as a reminder that while downturns can be uncomfortable, they have historically been temporary.

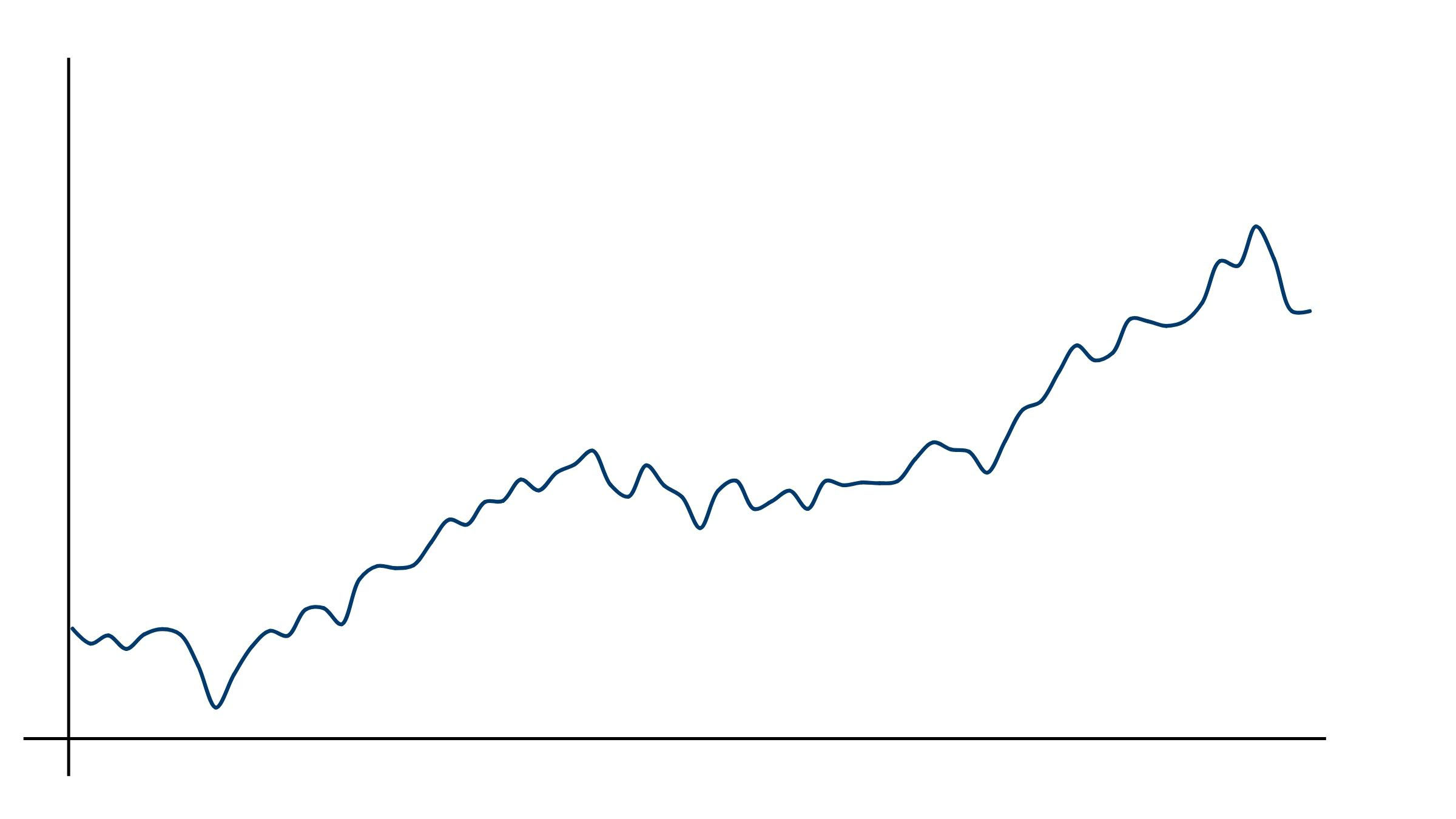

Staying invested through periods of volatility is key. Exiting the market prematurely not only risks missing the recovery – it can also lock in losses, turning a temporary dip into a permanent setback. Attempting to time the market – to buy and sell at just the right moment – is not only extremely difficult but often leads to missed opportunities.

This is clearly illustrated in the chart below. Starting with an investment of £10,000, the impact of missing just a handful of the market’s best-performing days can be significant – a powerful reminder of the benefits of staying the course.

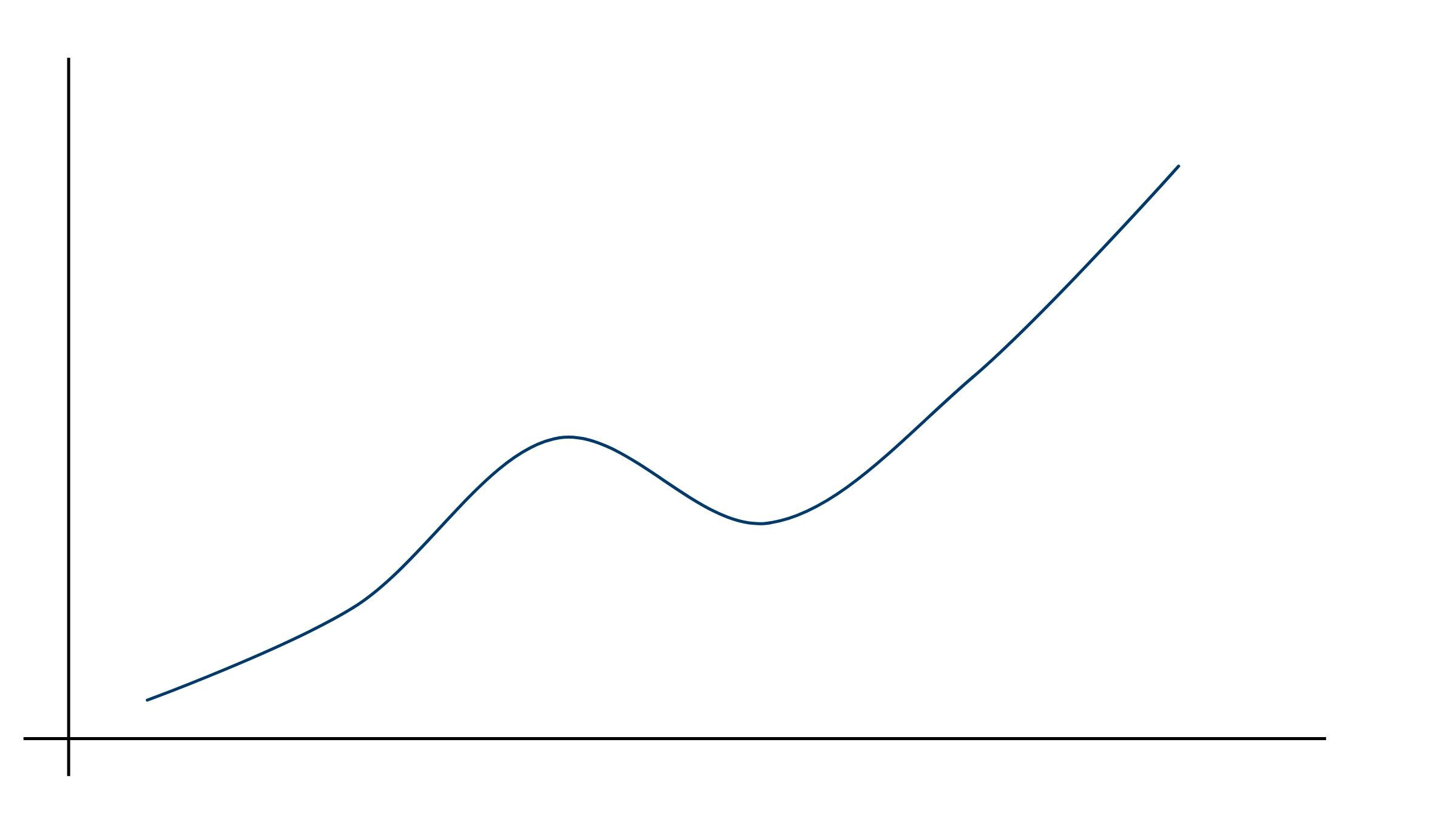

History consistently shows that, over time, equities tend to reward patient investors. The longer the investment horizon, the less influence short-term swings have on overall returns. This is why “time in the market” is so much more effective than trying to time the market.