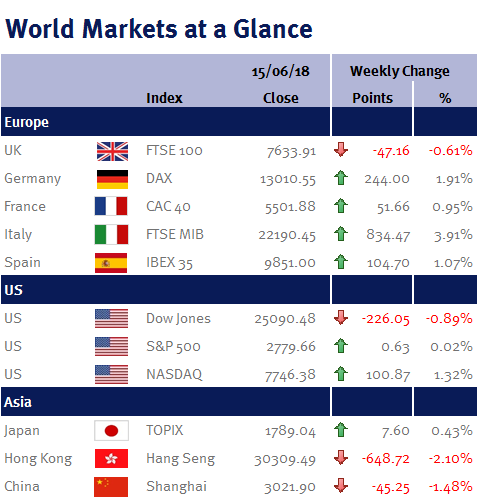

Week ending 15th June 2018.

18th June 2018

While the media was buzzing as a result of last weekend’s G7 meeting (which ended in turmoil following Donald Trump’s twitter attack on the Canadian Prime Minister, Justin Trudeau) and the summit between Donald Trump and Kim Jong Un (which was unsurprisingly light on any meaningful detail), neither actually impacted financial markets.

Instead, markets were absorbed with a calendar full of important economic data releases, not to mention Brexit negotiations.

However, the accompanying statement was more hawkish than expected as policymakers indicated that interest rates will now increase four times this year (from the previous guidance of three interest rate increases during 2018).

Additionally, the Fed Chairman, Jay Powell, stated that starting from next year, every policy meeting will be followed by a press conference (which makes every monetary policy meeting a ‘live’ meeting – and thus potentially allowing for a faster pace of interest rate increases in 2019).

As expected, the ECB left interest rates unchanged at -0.4% – but in contrast to the Fed, ECB policymakers were much more dovish than expected, as the ECB extended their QE program to the end of 2018 and pledged to keep eurozone interest rates unchanged for at least another year (i.e. to Q3 2019).

This resulted in a weakening of the euro (as by Q3 2019, when the ECB starts to consider increasing interest rates for the first time, the Fed could easily have increased US interest rates another four times).

In the UK, industrial production data came in below economist expectations and although the UK economy saw employment hit a record high after adding 146,000 jobs, wage growth slowed from 2.9% to 2.8%, suggesting that the economy still carries spare capacity.

UK CPI inflation came in at 2.4% for May (matching April’s reading) despite the headwind of a large increase in fuel pump prices – which clearly indicates that the impact of the pound’s weakness following the EU Referendum is dissipating quickly.

And as a consequence, unless we see a considerable improvement in UK economic data releases over the coming months, I can’t see myself changing my view: the BoE has no need to increase interest rates this year.

This coming week, the main focus will be the BoE’s monetary policy meeting; Jerome Powell, Mario Draghi and Haruhiko Kuroda (the heads of the Fed, ECB and BoJ) are all due to speak at the ECB’s annual conference in Portugal; and OPEC members meet in Vienna to debate a potential increase oil output.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.