Week ending 24th August 2018.

28th August 2018

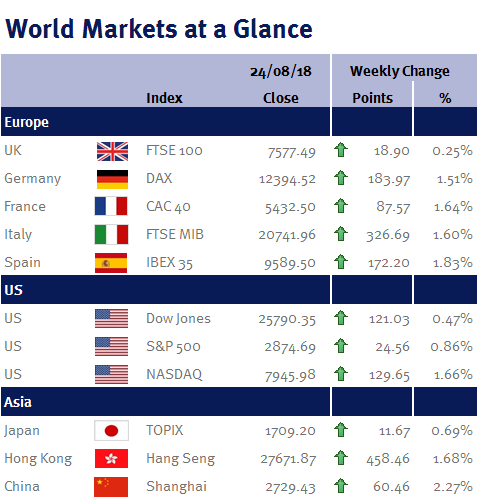

Thankfully, global equities ignored all the legal drama in the US and ended the week marginally higher – giving us a break from what has been a difficult month.

gradual pace for interest rate increases.

However, while the minutes effectively reinforced their plan for four interest rate increases this year (making a September increase a done deal thanks to recent solid US economic data), I would not yet bet on a December increase as these minutes predate the recent turmoil in Turkey and other emerging markets.

In fact, I would not be surprised if we see a slight waning in policymakers’ conviction over the coming months, especially if the trade war intensifies – although tariffs provide upward pressure on inflation, they will hurt US business sentiment, investment spending and employment.

It is difficult to say if this week’s raft of “no-deal Brexit” documents from the UK government is good advice (albeit long overdue) given the lack of progress in negotiations to date, or whether it is a negotiating tactic (as it potentially strengthens Theresa May’s chances of winning support for more compromises and thus the chances of a soft Brexit).

We have a fairly skimpy week ahead in terms of economic data. The main highlights include: US PCE (the Fed’s preferred inflation measure); eurozone CPI and unemployment; Japanese CPI; and Chinese PMI.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.