how much income do you really need in retirement?

5th September 2019

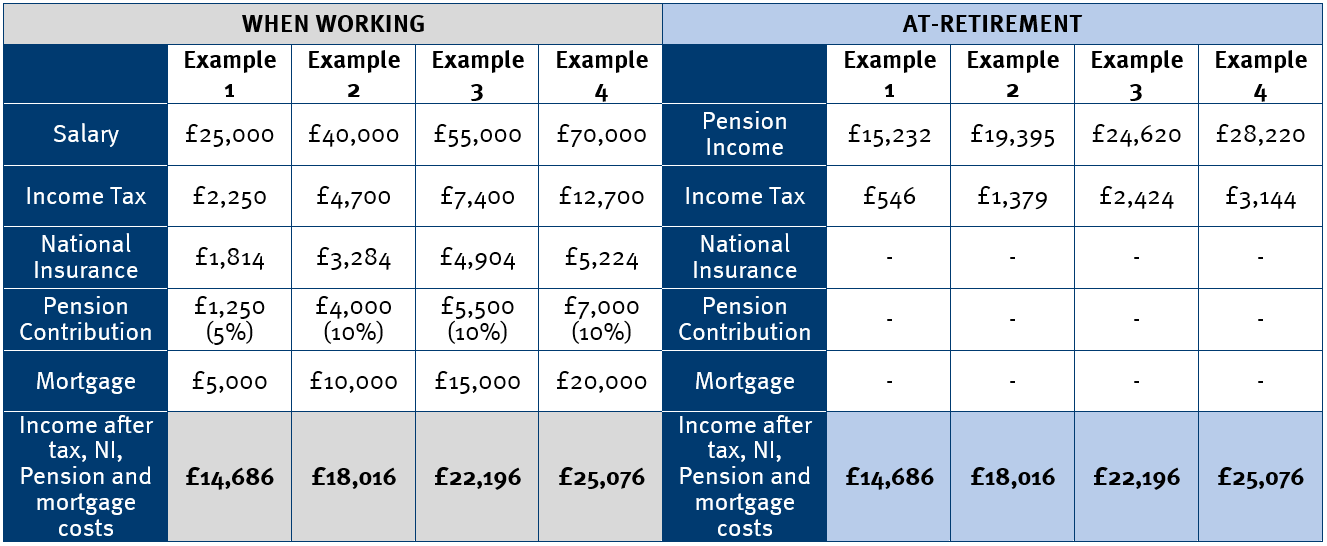

It is very important to save for your retirement but many people may not realise that it could be possible to have the same disposable income in retirement as when they were working, even if their pension income is less than half their salary.

This is because when someone retires, they may find that the deductions from their income are lower than those they experienced during their working life. For example, they may find they are paying less Income Tax, no National Insurance (NI), mortgages and loans may be paid off, and there may be no costs for children who become financially independent.

WEALTH at work – a specialist provider of financial education and guidance in the workplace supported by regulated advice for individuals, has run retirement seminars for hundreds of thousands of employees and has created the four examples below to demonstrate how much income individuals would need in retirement to have a similar level of disposable income as to when they were working.

The following examples* are for illustrative purposes only and are based on an active individual with no health issues, contributing towards their workplace pension through salary sacrifice for the tax year 2019/20, who will have paid off their mortgage and loans by the time they retire, and took their 25% tax free lump sum at-retirement – meaning that all pension income is now liable for income tax.

Example 1:

James – Earns £25,000 p.a. but needs only £15,232 income in retirement

James has a salary of £25,000 p.a. and is making a 5% contribution into his workplace pension scheme. His other current costs are:

- £5,000 p.a. mortgage payment (he plans to clear this debt by the time he retires)

- £2,250 p.a. Income Tax deducted from his salary

- £1,814 p.a. National Insurance deducted from his salary

His disposable income after these deductions is £14,686. To have the same amount of disposable income in retirement he would need a pension income of £15,232 (£15,232 minus £546 income tax leaves £14,686 disposable income).

Example 2:

Wendy – Earns £40,000 p.a. but needs only £19,395 income in retirement

Wendy has a salary of £40,000 p.a. and is making a 10% contribution into her workplace pension scheme. Her other current costs are:

- £10,000 p.a. mortgage payment (she plans to clear this debt by the time she retires)

- £4,700 p.a. Income Tax deducted from her salary

- £3,284 p.a. National Insurance deducted from her salary

Her His disposable income after these deductions is £18,016. To have the same amount of disposable income in retirement she would need a pension income of £19,395 (£19,395 minus £1,379 income tax leaves £18,016 disposable income).

Example 3:

Catherine – Earns £55,000 p.a. but needs only £24,619 income in retirement

Catherine has a salary of £55,000 p.a. and is making a 10% contribution into her workplace pension scheme. Her other current costs are:

- £15,000 p.a. mortgage payment (she plans to clear this debt by the time she retires)

- £7,400 p.a. Income Tax deducted from her salary

- £4,904 p.a. National Insurance deducted from her salary

Her His disposable income after these deductions is £22,196. To have the same amount of disposable income in retirement she would need a pension income of £24,620 (£24,620 minus £2,424 income tax leaves £22,196 income in retirement).

Example 4:

Simon – Earns £70,000 p.a. but needs only £28,220 in retirement

Simon has a salary of £70,000 p.a. and is making a 10% contribution into his workplace pension scheme. His other current costs are:

- £20,000 p.a. mortgage payment (he plans to clear this debt by the time he retires)

- £12,700 p.a. Income Tax deducted from his salary

- £5,224 p.a. National Insurance deducted from his salary

His disposable income after these deductions is £25,076. To have the same amount of disposable income in retirement he would need a pension income of £28,220 (£28,220 minus £3,144 income tax leaves £25,076 income in retirement).

Summary of examples

The table below is a summary of the above examples, which shows the annual income individuals would need in retirement to have a similar disposable income as to when they were working. We have assumed pension contributions would increase to 10% for someone earning £40,000 and over, and that annual mortgage repayments would increase £5,000 for every extra £15,000 earned.

These examples are used for illustrative purposes only and must not be relied upon to make any calculations or financial decisions.

Jonathan Watts-Lay, Director, WEALTH at work comments;

“When some individuals see the predicted income on their pension statements and realise it is a lot less than their working income, they may be concerned. However, what many don’t realise is that they may not need as much income in retirement as they think.”

He continues; “When you retire, you will often be paying a lot less Income Tax, have no National Insurance or pension contributions, and often mortgages and loans are paid off. There will be new expenses such as hobbies, hopefully more holidays, and utilities may be more expensive as you could be at home more, but these expenditures are unlikely be anywhere near the ones that you will no longer have.”

Watts-Lay concludes, “We hope these examples will encourage individuals to review how much income they will actually need in retirement, and gain a better understanding of how much they need to be saving now to achieve this. With careful planning, some may even find that they are able to have the same disposable income in retirement as when they were working.”

Further coverage was gained in LoveMoney.

The latest news is brought to you by WEALTH at work, a leading financial wellbeing and retirement specialist. WEALTH at work and my wealth are trading names of Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.