Week ending 3rd March 2017.

6th March 2017

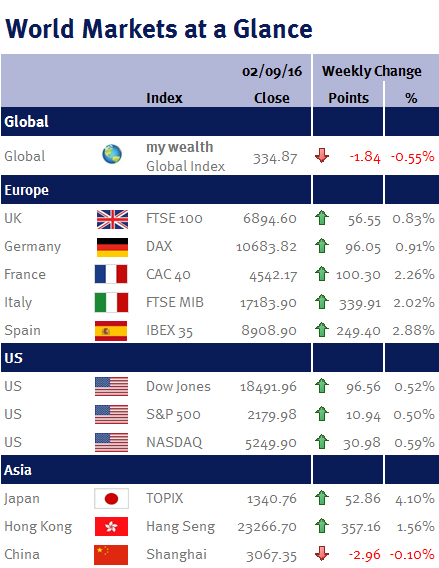

Global equities continued setting records this week. In the US, the Dow Jones Industrial Average rose above 21,000 for the first time ever (it was only 5 weeks ago that I wrote saying that the Dow had breached the 20,000 milestone for the first time). In the UK, the FTSE-100 hit a record high of 7,394.61 helped by a weaker pound, which fell to a 6 week low of 1.2258 against a stronger dollar and 1.1606 against the euro (FTSE-100 constituents earn more than 70% of their revenues outside of the UK, so the market tends to move in reverse lockstep with the pound).

However, it was comments from a number of Federal Reserve (Fed) policy-makers that sent equity markets higher as investors grew increasingly confident that economic growth is accelerating.

In fact Donald Trump’s speech was a bit of a damp squib in investment terms. While he struck a more Presidential tone and managed to avoid any major howlers, unfortunately he didn’t say very much about the main issues on the markets’ mind: infrastructure spending; tax cuts; and deregulation.

Arguably more important for markets this week was the numerous speeches made by a range of Fed policy-makers, including William Dudley, Jerome Powell, John Williams, Lael Brainard, Stanley Fischer and the Fed Chair, Janet Yellen. All suggested that the return to monetary normality (whatever that means in today’s world) is underway regardless of whether Mr Trump adds fiscal stimulus to the mix, by pointing towards an increase in interest rates, potentially at the Feds next meeting on 14-15 March 2017.

Compounding the expectation was news that fewer than expected Americans applied for unemployment benefits last week – indicating the employment market continues to strengthen. Jobless claims fell by 19,000 to 223,000 in the week ended 25 February 2017, the fewest since March 1973.

However the Beige Book (the US central bank’s economic report based data collected during January and the first half of February 2017) said that the US economy was growing at a modest to moderate pace without any significant acceleration in wages or inflation!

Elsewhere, although European inflation hit its 2% target for the first time since January 2013, the European Central Bank indicated that weakness in underlying price growth justified continuing with its stimulus program.

The week ahead brings US payroll data (which will be of particular interest given this week’s Fed comments – see above); industrial output data for Germany, France and the UK; and China reveals the country’s proposed key economic targets for the year. On Wednesday (8 March 2017) in the UK the Chancellor of the Exchequer, Philip Hammond, presents his first annual budget statement.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.