Week ending 13th January 2017.

16th January 2017

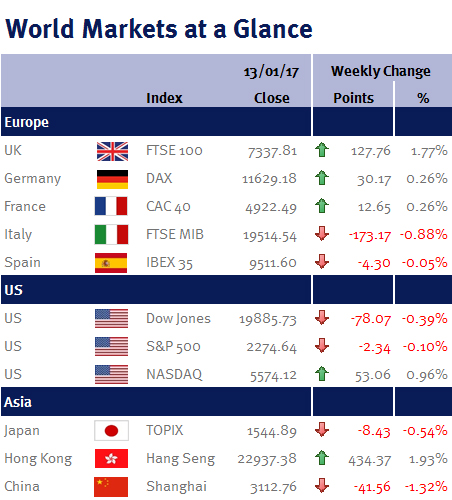

Despite a wobble after Donald Trump’s press conference on Wednesday (as he did not give any timeline for his stated tax cuts or reforms) most global equity markets extended their recent gains this week.

The FTSE-100 ended the week capping a 14th consecutive rise and 12th consecutive record close – the longest record-setting streak in its 33-year history. However, the Dow Jones again failed to breach the 20,000 level.

China’s PPI (producer prices) rose at its fastest pace in just over 5 years thanks to higher input costs (commodities) and a weaker yuan (the Chinese currency). However, history shows that it is simply a matter of time before this results in higher CPI (inflation) in the US, UK and Europe (see below).

Looking ahead, the main focus this week will be on Theresa May’s speech outlining her vision for Brexit. Most of her Brexit comments since becoming Prime Minster have suggested that her priority will be on border control and restricting immigration over access to the single market (a hard Brexit) – and her comments could result in a bumpy week for sterling.

Elsewhere, US markets are closed on Monday (16 January) for Martin Luther King Jr. Day; world leaders, economists and bankers attend the World Economic Forum in Davos; and we have UK, US, eurozone CPI data. Furthermore Mark Carney delivers his first speech of the year and may refer to Brexit uncertainty and sterling’s weakness (and its impact on CPI) – providing clues on the future direction of UK interest rates.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.