Week ending 18th November 2016.

21st November 2016

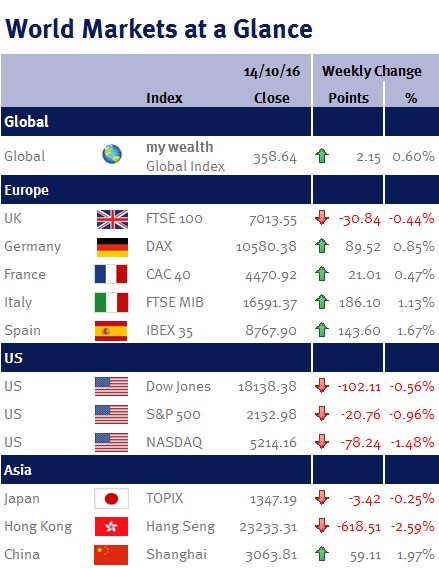

After trading in a narrow range global equities ended the week a touch higher.

US markets continued to be helped by hopes that Donald Trump’s Presidential election win will result in tax cuts and pro-economic growth policies. On Thursday (17 November) the S&P 500 came within 3 points of August’s all-time high of 2,190.15.

Elsewhere, UK inflation data surprised on the downside by slowing in October, reinforcing our view that UK interest rates will stay low for longer. The Office for National Statistics (ONS) said that the Consumer Price Index (CPI) inflation was 0.9% last month, down from 1% in September.

Economists had predicted the rate would increase to 1.1%. However, this is likely to prove temporary due to the building cost pressures as a result of the pound’s weakness following the Brexit vote on 23 June 2016 – the ONS also released figures that showed the cost of goods leaving factory gates rose 2.1% (the fastest annual pace since April 2012).

UK employment and retail sales also showed little sign of any referendum impact: the headline unemployment rate dropped to 4.8% in September from 4.9% previously (however, the growth in employment of 49,000 was slightly slower than expected), while retail sales rose at their fastest pace in over a decade, jumping 1.4%, helped by colder October weather which boosted clothing sales.

This Wednesday (23 November) is an important day: in the UK, Philip Hammond, the Chancellor of the Exchequer, presents his first Autumn Statement to Parliament, while in the US, we get the chance to read the minutes from the last Federal Reserve Bank’s (Fed) policy meeting, so we should be able to assess the prospects for an interest rate rise at the Fed’s next meeting on 13-14 December.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.