Week ending 4th November 2016.

7th November 2016

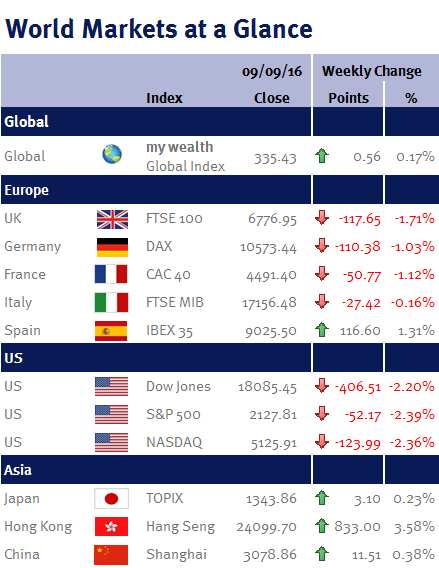

Global equity markets ended the week lower as polls tightened ahead of the US Presidential election on 8th November, while the price of oil declined and central banks maintained interest rates.

In the US, the FOMC (Federal Open Market Committee) voted to leave interest rates unchanged. Given the forthcoming election this was expected, however, in the accompanying statement the FOMC said “the case for an increase in the federal funds rate has continued to strengthen”, paving the way for an increase at their next meeting on 13-14 December.

Furthermore, data released on Friday showed continued solid employment growth in the US (including upward revisions to prior months), while wages grew faster than expected. However, a slight decline in the labour participation rate (a measure of people employed or actively looking for work) does mean that an interest rate increase next month is not yet a certainty.

In the UK, the Bank of England’s Monetary Policy Committee also left interest rates unchanged despite raising their economic growth forecasts (as households appear more resilient than anticipated) and inflation expectations for next year (as the fall in the pound since the Brexit vote starts to impact the price of imported goods).

This coupled with the high court ruling that the UK government must hold a vote before officially triggering the process to leave the EU, pushed the pound higher over the week – rising 2.7% against the US dollar.

Elsewhere, the price of Brent crude oil declined 5% during the week following reports OPEC (Organization of the Petroleum Exporting Countries) is struggling to agree production cuts coupled with data showing that US inventory increased by more than expected.

Peter Quayle, Investment Management Expert*

*Peter Quayle is a Fund Manager at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.