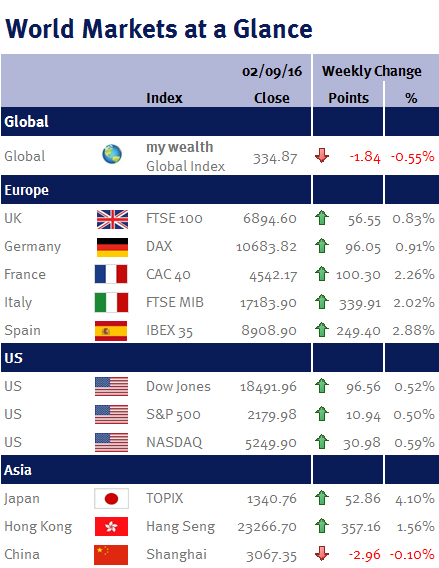

Week ending 2nd September 2016.

2nd September 2016

Underwhelming US jobs data sent equities strongly higher on Friday afternoon, salvaging the week for investors.

After comments by Janet Yellen, the chair of the US Federal Reserve Bank (Fed), at the annual meeting of the world’s central bankers in Jackson Hole last weekend that the case for increasing US interest rates had “strengthened”, global equity markets drifted lower at the start of the week in anticipation of Friday’s job data and clues on the timing of the Fed’s next move.

However, the US jobs data actually showed that payrolls grew at a slower (but solid pace), of 151,000 in August, following a 275,000 gain in July. As a result the unemployment rate was unchanged at 4.9%. Average hourly earnings rose just 0.1%.

This shows that while the US economy continues to grow there appears to be little need for an immediate increase in interest rates (some US Federal Reserve Bank officials have been implying that US interest rates could rise later this month).

The price of Brent crude oil also declined at the start of the week following news that US crude oil inventory levels continued to build, before rebounding on Friday following remarks by Russian President, Vladimir Putin, who said oil producing nations should freeze output to stabilise oil prices. Brent oil gained $0.72 on Friday to close at $45.85 per barrel, down $3.28 on the week.

In the UK, the composite Purchasing Managers Index jumped to 53.3 in August as a weaker Sterling helped factory activity bounce back from a post-Brexit slump (a reading above 50 indicates that the UK economy is generally expanding and below 50 indicates contraction).

Elsewhere, German inflation slowed in August to 0.3% from 0.4% in July – a sign that the European Central Bank may need to do more to meet its goal for price growth in the Eurozone (potentially by extending and/or tweaking the terms of its QE).

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.