Week ending 2nd February 2018.

5th February 2018

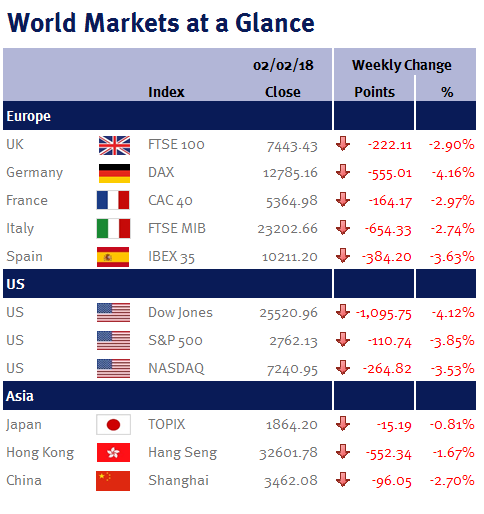

Global equity prices fell this week in a classic knee-jerk reaction to higher US bond yields following a hawkish Fed statement and strong US employment data.

Having spent the last four years being dovish, in her final monetary policy meeting, Janet Yellen, the Fed Chair, was relatively hawkish – giving an upbeat assessment on both the economy and inflation. Although the Fed didn’t change US interest rates this week, the statement sets the stage for a March interest rate increase under the new Fed Chair, Jerome Powell (who will be sworn in on Monday 5 February 2018).

In the UK, the BoE Governor, Mark Carney stated that slack in the UK economy is easing and that the BoE focus can now switch to inflation. This is strange given that he also stated that business investment is likely to be 4% lower than it would have been had the UK voted to remain in the EU or that the IMF expects that the UK’s economy will grow by just 1.5% this year, compared to 2.2% for the eurozone and 2.7% for the US. For information, this coming week we have the BoE’s interest rate decision and Inflation Report.

While I appreciate that the path of US interest rates may steepen slightly following Donald Trump’s massive tax cuts, market speculation (lead by Morgan Stanley strategists) of 5 increases this year seem wide of the mark. Although economic readings are strengthening, the pickup is insufficient to validate the idea that inflation is going to rapidly accelerate (the Fed’s preferred inflation measure, the core PCE, was unchanged in January at 1.5%).

And while this week’s sell-off is unwelcome, it is hard to argue that it wasn’t justified given the aggressiveness of the recent rise. However, as the drivers of the rise (synchronized global growth, historically low interest rates/inflation and a US tax windfall) are still present it is important not to get distracted (or bearish) by an overdue correction.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.